Traders don’t like their funds sitting on an exchange doing nothing. Therefore we tasked our data people with answering the question of which is better; more trades or larger trade size.

3 bots were set up, each with the same amount of BTC available to the bot. The smaller the number of pairs, the higher the BTC trade value. We ran this live for 20 days on 3Commas using Keiko Alert signals.

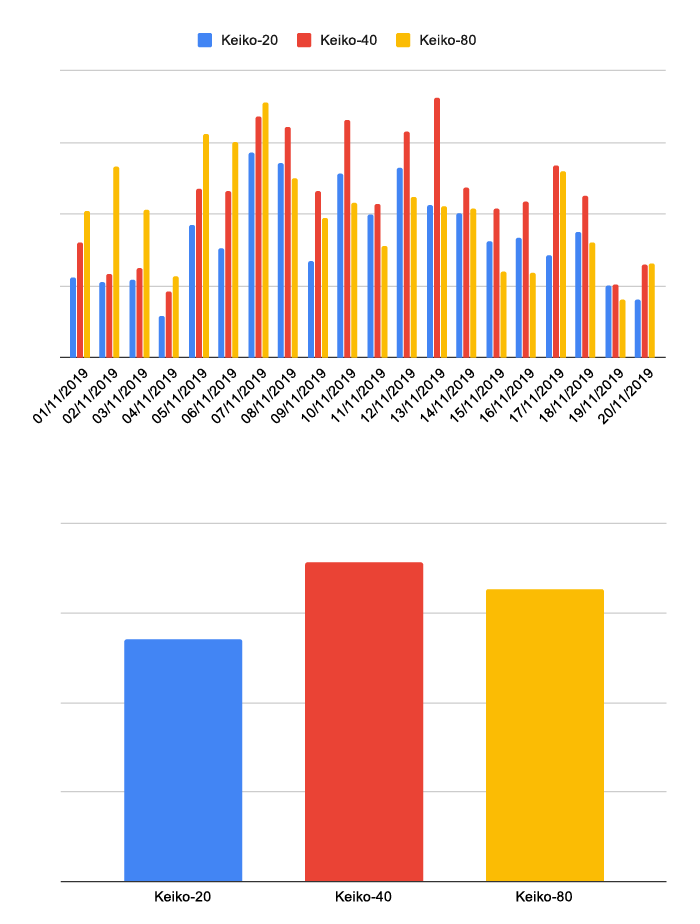

Keiko 20 was trading 20 BTC pairs, Keiko 40 was trading 40 BTC pairs, Keiko 80 was trading 80 BTC pairs.

Keiko 20: Recommended settings / 20 pairs

Keiko 40: Recommended settings / 40 pairs

Keiko 80: Recommended settings / 80 pairs.

At the time only 69 BTC pairs had signals, so we achieved 80 by using the 3Commas setting of Simultaneous Deals.

As you can see from the results Keiko 40 and Keiko 80 were quite close, and perhaps under different market conditions, things might have been different. Our takeaway on this is that smaller trade size and more pairs is more profitable. This also has the advantage that if a particular trade turns bad, the amount of funds locked up in the trade is smaller.

A word of caution: These results are specific to the start conditions which trigger our signals. DO NOT adjust other bots you may have to Keiko settings because entirely different results will be generated. Our settings perform because they based on the Keiko start conditions.

This live-trade experiment took place in November 2019. We continue to monitor number of pairs vs trade size, and more pairs still works more favourably.